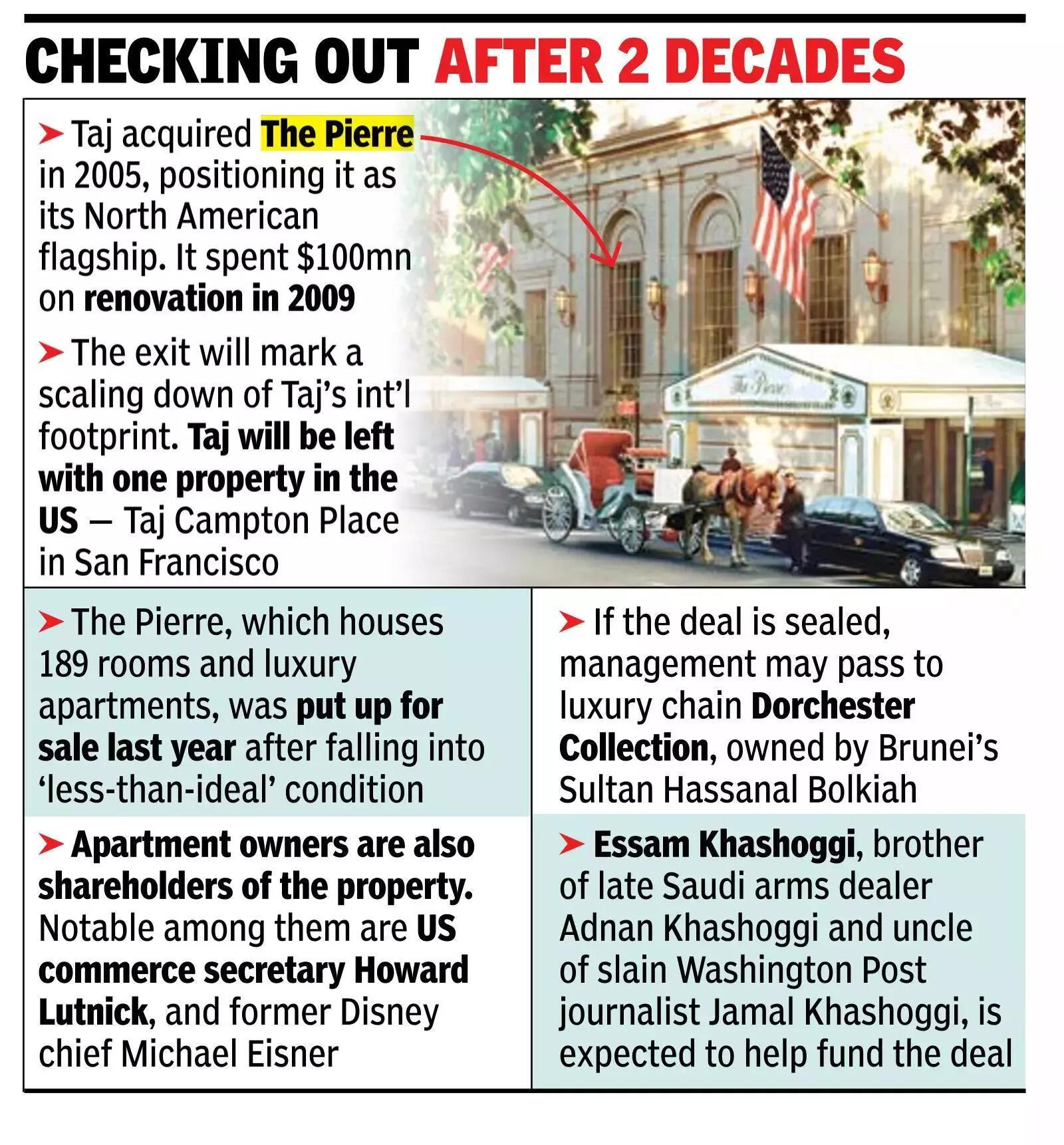

MUMBAI: New York’s The Pierre Hotel, managed by the Taj chain, may see a change in ownership. The Sultan of Brunei, along with Saudi businessman Essam Khashoggi, has expressed interest in buying the iconic Manhattan property for $2 billion.If the deal is sealed, Taj could check out of the Pierre after nearly two decades of management. This will leave Taj with one property in the US — Taj Campton Place in San Francisco. Taj offered no comments to TOI’s questions.According to Taj’s website, it acquired The Pierre in 2005, positioning it as its North American flagship, and four years later, it completed a $100-million renovation of the luxury hotel.Both the New York and San Francisco hotels are under United Overseas Holding (UOH), a 100% subsidiary of the Mumbai-listed Indian Hotels (IHCL), which owns the Taj chain and is part of the $165-billion Tata Group. IHCL made an equity investment of Rs 2,324 crore in UOH in FY25, company reports showed. UOH, however, reported a loss of Rs 82 crore during that period.

The Pierre, which houses 189 rooms, restaurants, and luxury apartments, was put up for sale last year after falling into ‘less-than-ideal’ condition. Apartment owners are also shareholders of the property. Notable among them are US commerce secretary and in-charge of president Donald Trump’s trade negotiations Howard Lutnick (who owns a penthouse); Princess Firyal of Jordan; fashion designer Tory Burch; and former Disney chief Michael Eisner.NYT reported that Taj has defended its stewardship of the property and proposed upgrades that would not require residents to move out. The paper also noted that The Pierre’s board is in the final stages of negotiations for the sale.If the transaction goes through, management may pass to luxury chain Dorchester Collection, owned by Sultan Hassanal Bolkiah, following extensive renovations. Essam Khashoggi, brother of late Saudi arms dealer Adnan Khashoggi and uncle of slain Washington Post journalist Jamal Khashoggi — who was killed inside a Saudi consulate in Turkey in 2018 — is expected to help fund the deal.The exit would mark a scaling down of Taj’s international footprint. IHCL chairman N Chandrasekaran recently told shareholders that the company has no aggressive overseas expansion plans. “In terms of overseas expansion — we are not looking at every global market. For places like Africa, New Zealand, and South Africa, we will consider city-specific opportunities, but we will not pursue widespread international expansion,” he said at the July AGM. IHCL’s international hotels generated revenue of about Rs 1,512 crore and an operating profit of Rs 202 crore in FY25.