The Income Tax Department has released the Draft Income Tax Rules 2026, which once approved will be applicable for FY 2026-27. For salaried and middle class income taxpayers, several changes have been proposed, which will have implications for their taxable income and total tax outgo.These draft rules propose to make significant changes to the limits and scope of coverage for popular exemptions such as house rent allowance, children education allowance, hostel allowance etc. which had not been revisited in several decades. Additionally, the requirement of quoting PAN card for several transactions has undergone revision.The draft income tax rules correspond to the new Income Tax Act 2025 which is set to be implemented from April 1, 2026. These draft rules are open for suggestions till 22 February 2026, after which the government will notify the final rules for implementation.According to Kuldip Kumar, Partner, Mainstay Tax Advisors, the draft reflects the approach adopted in the Income-tax Act, 2025, with simplified language, improved structure, and the removal of redundant provisions, making the rules easier to read and reference. “While introducing these changes, the government has also kept relevance and practicality in view,” Kuldip Kumar tells TOI.What do the draft income tax rules mean for the common man? How does the calculation math for the old vs new income tax regime change? How much more tax can you now save under the old regime with revised exemption and deduction limits? Here are the top changes taxpayers should know:

HRA Benefits: Number of Cities for 50% Exemption Increased

In a big relief for taxpayers in major metro cities, the draft Income Tax Rules 2026 propose to include Ahmedabad, Pune, Bengaluru, and Hyderabad in the 50% limit category.The 50% HRA exemption (currently only for metro cities like Delhi, Mumbai, Chennai, Kolkata) is proposed to be extended to other large cities such as Bengaluru, Hyderabad, Pune, and Ahmedabad, allowing employees in these cities to claim a higher tax-free HRA.What is the current HRA rule? At present HRA exemption is calculated as 50% of salary if you live in a metro, or 40% of salary if you live in a non-metro city. Now, employees in the added list of cities will be able to avail higher HRA exemptions.As Shalini Jain, Tax Partner at EY India explains: for house rent allowance, while the formula for calculating the exemption amount has not changed, the draft rules propose to increase the number of cities for which 50% of “salary” needs to be considered for the purpose of calculating the exemption amount. “Cities such as Hyderabad, Pune, Ahmedabad and Bengaluru are proposed to be added to the list taking into account growing population and job opportunities in these cities,” she tells TOI.According to Richa Sawhney, Partner – Tax, Grant Thornton Bharat, the proposal to extend the 50% HRA exemption to Bengaluru, Hyderabad, Pune, and Ahmedabad rightly acknowledges the sharp rise in rental costs in these cities. “Housing expenses have escalated rapidly in recent years, and this move would provide meaningful relief to taxpayers residing in these cities,” she tells TOI.Kuldip Kumar of Mainstay Tax Advisors sees a limited impact on the exchequer, as a large number of taxpayers have already shifted to the new tax regime, where HRA exemption is not available.

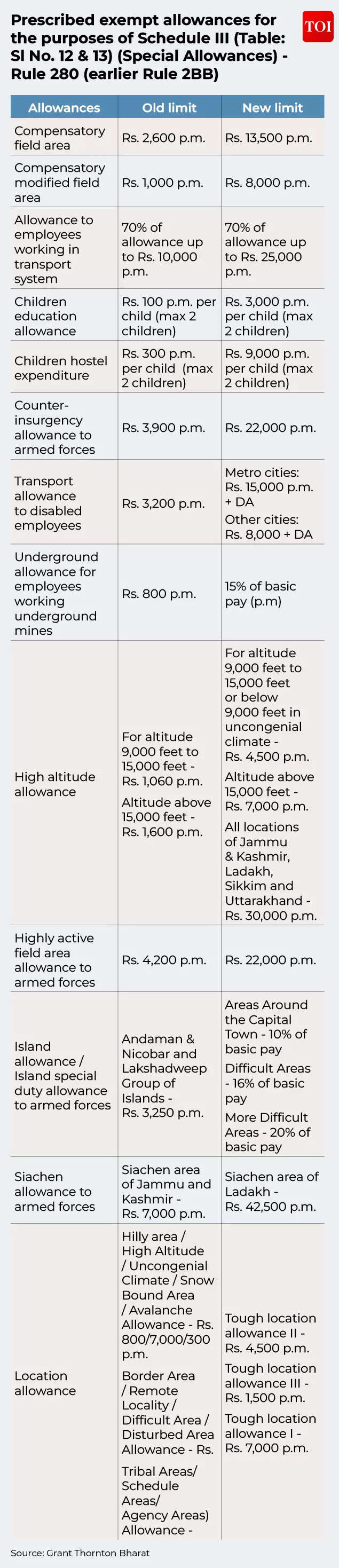

Education, Hostel Allowance Hike

For children education allowance, the exemption limit of Rs 100 per month per child is proposed to be increased to Rs 3,000 per month per child which is a significant jump from the current monetary limit.Similarly, for hostel expenditure, the exemption limit is proposed to be increased to Rs 9,000 per month per child under the draft rules as compared to Rs 300 per month per child available under the current Income-tax Rules, 1962. Both these exemptions can be availed for a maximum of 2 children by the taxpayer.“While these proposed revisions are much needed considering the exponential increase in education and hostel expenses over the years and rising migration of taxpayers to other cities, these exemptions are available only if the salaried taxpayer opts for the old tax regime for taxation purpose,” Shalini Jain from EY India points out.

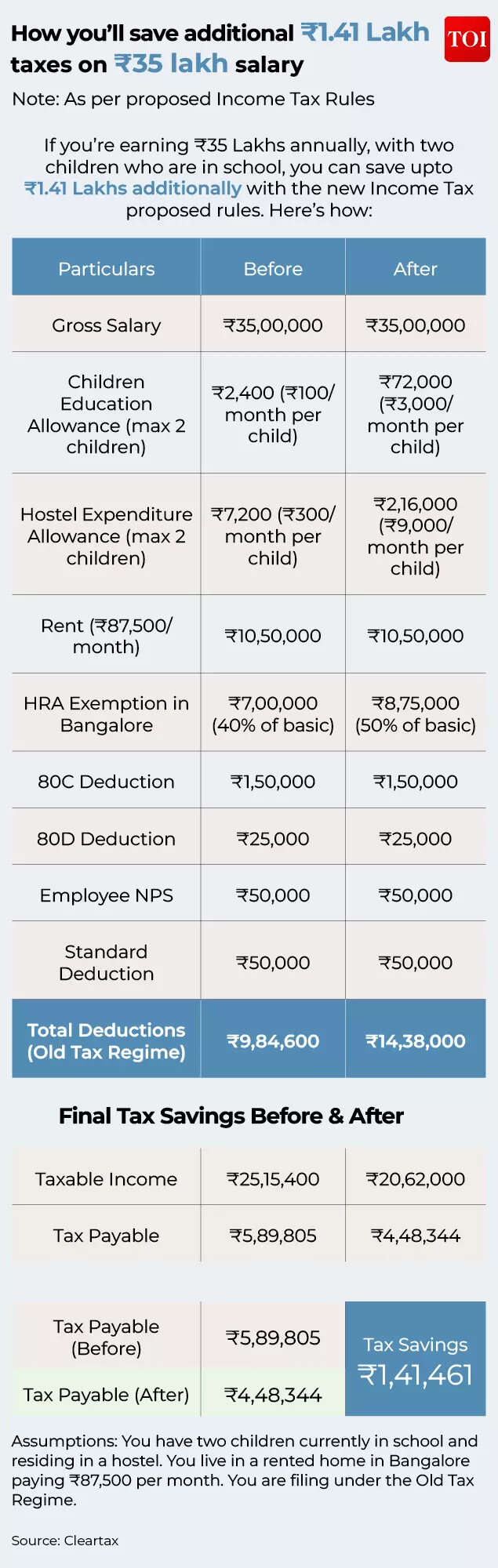

How You Can Save Rs 1.41 Lakh Tax

According to an analysis by ClearTax done for TOI, an individual with two kids earning around Rs 35 lakh in a city like Bengaluru, the tax benefit under the old income tax regime will go substantially.Archit Gupta, Founder and CEO of ClearTax explains with an example:

In this case study, he looks at a professional living in a rented home in Bengaluru (paying Rs 87,500/month) with two children in a hostel. The savings come from some specific updates in the draft rules:1. The Metro Upgrade (HRA)

- The Change: Bengaluru is proposed to move from a 40% to a 50% HRA exemption city.

- The Impact: This instantly increases the HRA deduction limit. In this case, the exempt HRA jumped from Rs 7 lakh to Rs 8.75 lakh, reducing taxable income by Rs 1.75 lakh.

2. Education & Hostel Allowances

- The Change: The old allowances were quite insufficient. The draft proposes Rs 3,000/month for education and Rs 9,000/month for hostels per child.

- The Impact:

- Old Rules: You could claim only Rs 9,600 per year for two kids (Education: Rs 2,400 + Hostel: Rs 7,200).

- Draft Rules: You can claim Rs 2.88 lakh per year (Education: Rs 72,000 + Hostel: Rs 2.16 lakh).

- Result: An additional Rs 2.78 lakhs is removed from taxable income.

The Bottom Line: These changes combined lower the total taxable income by about Rs 4.5 lakh, when filed in the old tax regime.

- Tax before draft reforms: Rs 5,89,805

- Tax After draft reforms: Rs 4,48,344

- Net Saving: Rs 1,41,461/-

“For an individual earning Rs 35 lakh, saving over Rs 1.41 lakh isn’t just a deduction on paper, it is real money back in the pocket. “This is a pro-middle-class correction that finally helps balance income against the rising cost of living,” Archit Gupta tells TOI.

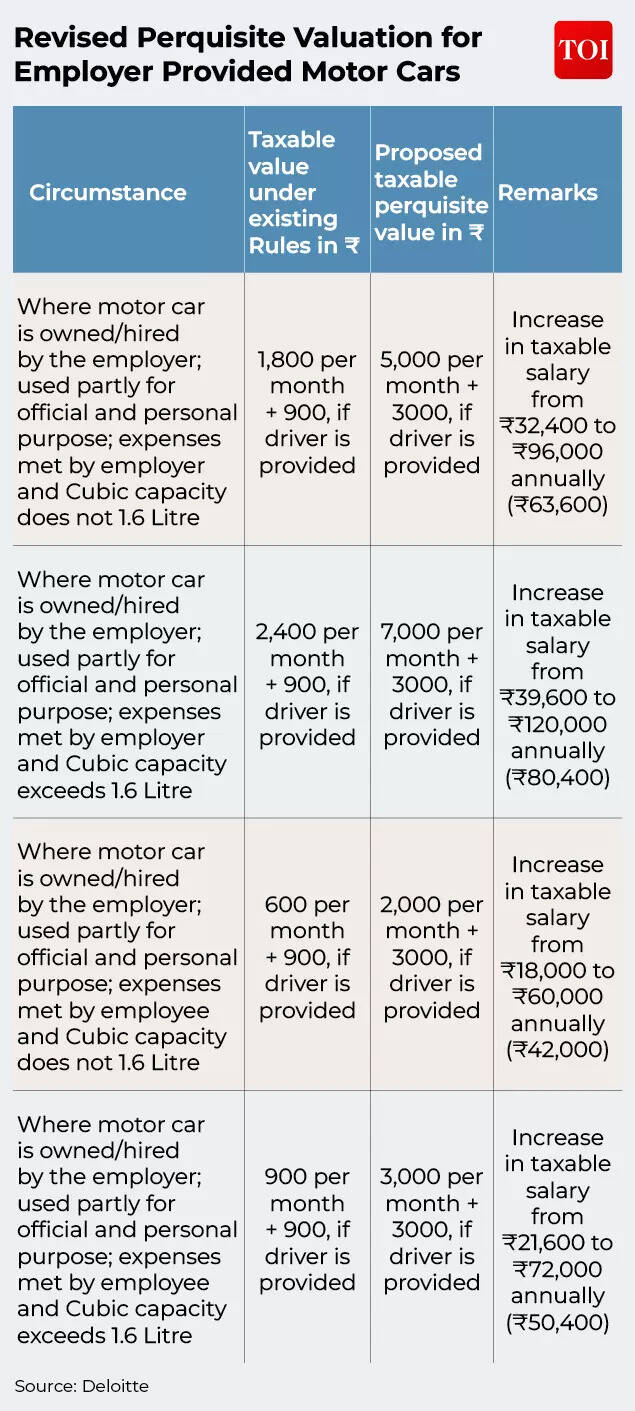

Revised Perquisite Valuation for Employer Provided Motor Cars

According to Kuldip Kumar, the increase in the valuation of employer-provided cars used for both official and personal purposes—where running and maintenance costs are borne by the employer—will adversely affect impacted employees (generally mid-level and above who get this benefit). The annual additional tax impact for such employees in the 30% tax bracket could range from approximately Rs 19,843 to Rs 31,356, depending on engine capacity of the car provided and the applicability of surcharge based on their income levels, he tells TOI.Sudhakar Sethuraman, Partner, Deloitte India explains how the method of valuing perquisites where a company provides a car to an employee has been updated as under:

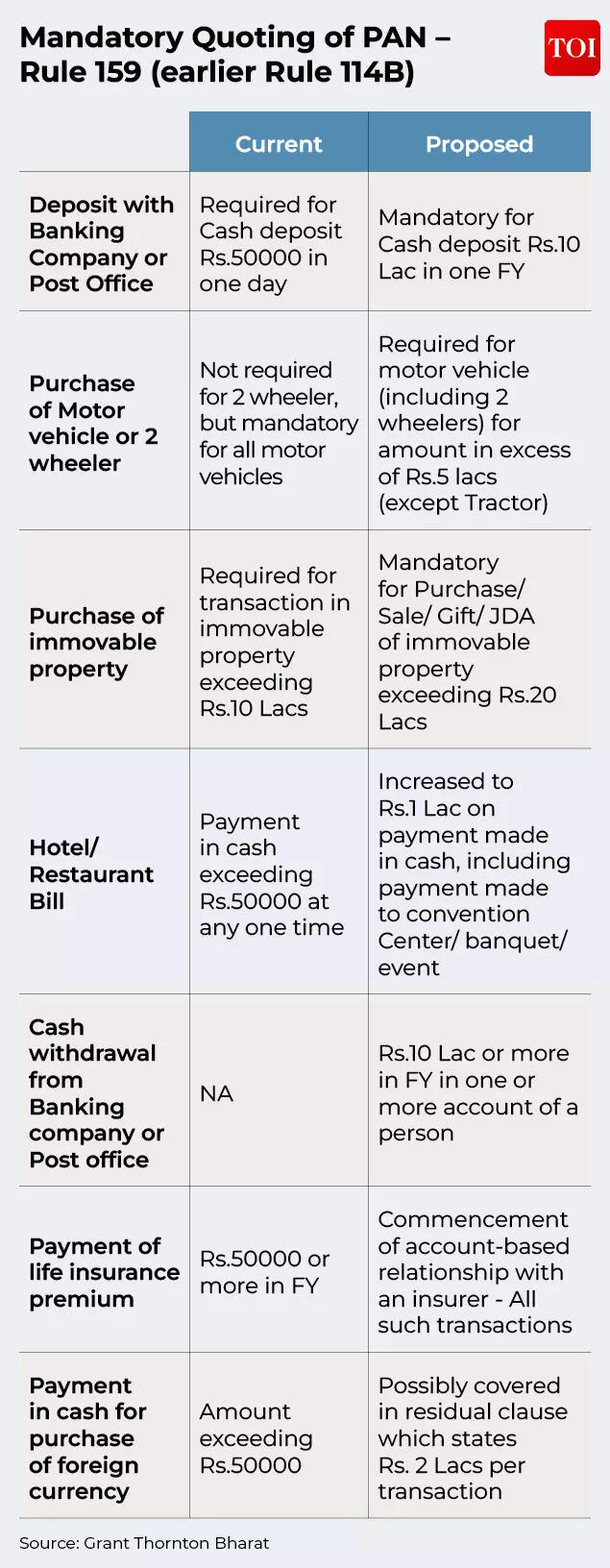

Mandatory Quoting of PAN Card

The draft Income Tax Rules 2026 also propose changes to the limits of several transactions where PAN Card number needs to be quoted. For example, presently if you deposit cash above Rs 50,000 in a day, you need to quote your PAN Card. Under the new rules, PAN Card will be mandatory for cash deposit of Rs 10 lakh in a financial year.Similarly, cash withdrawal from a banking company or post office of more than Rs 10 lakh in a financial year will now require a PAN Card, if draft rules are approved. Below is the full list of changes you should know:

Draft Income Tax Rules 2026: Some Other Important Changes

- Loans from the employer: Currently, interest-free or concessional loans from an employer are taxable as perquisites, unless the total loan amount is below Rs 20,000. The Draft Rules propose increasing this threshold to Rs 2,00,000. This means loans up to Rs 2 lakh from the employer will not attract perquisite tax.

- Gifts and Vouchers: At present, gifts/vouchers up to Rs 5,000 per year are taxfree. The Draft Rules propose increasing this limit to Rs 15,000 per year, giving employees a larger nontaxable benefit.

- Meal coupons: Limit may be enhanced from Rs 50 to Rs 200 per meal

- Foreign Tax Credit (FTC) Compliance: To claim foreign tax credit, taxpayers currently submit Form 67. Under the Draft Rules, Form 67 is replaced by Form 44. If the foreign taxes paid are Rs 1,00,000 or more, Form 44 must be verified by an accountant. This adds an additional layer of verification for higher foreign tax credits.

“The enhancement of other limits—such as gifts in kind, interest-free loans, and free food from Rs 50 to Rs 200 per meal—is likely to benefit a wide range of salaried employees, particularly in sectors such as IT where such benefits are commonly provided,” Kuldip Kumar tells TOI.He is of the view that the government is now well placed to consider, in the near future, an automated mechanism to periodically revise these limits by linking them to the Cost Inflation Index, so that the real value of benefits is preserved year on year, rather than requiring adjustments after long intervals. “This should also be extended to standard deduction and other available deductions under the Income Tax Act, 2025,” he says.

New vs Old Tax Regime : The Choice After Hike In Exemptions

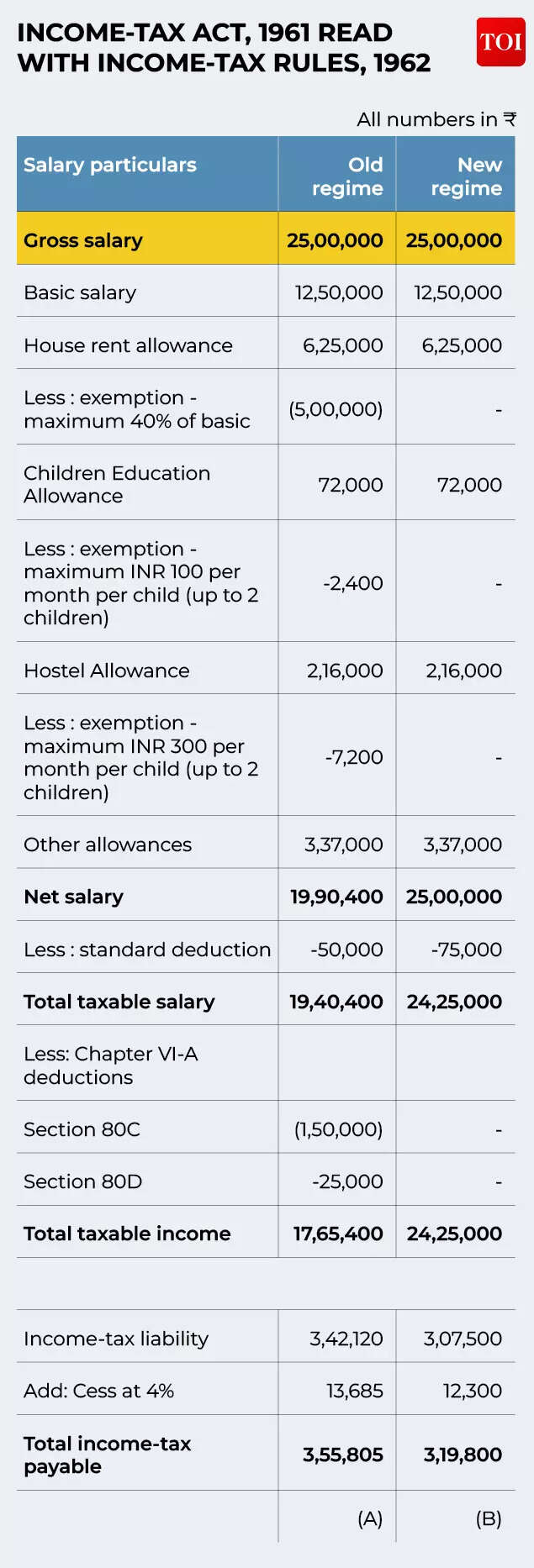

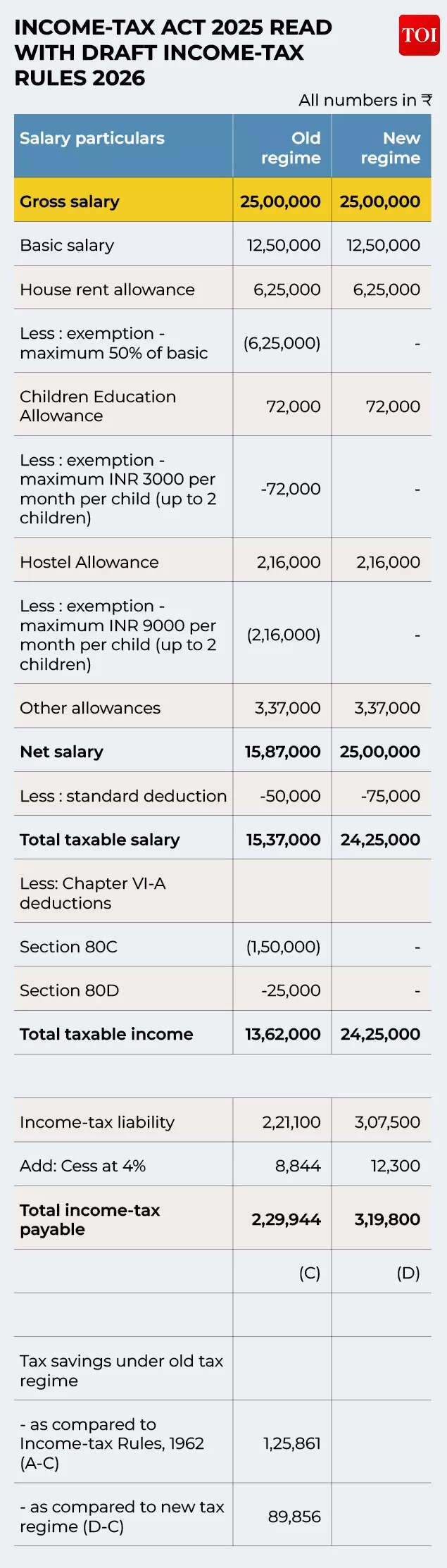

It is important for taxpayers to note that benefits of a hike in HRA exemptions for some cities, educational and hostel allowances are only available under the old income tax regime. Hence, the choice between the new and old income tax regime assumes importance for the upcoming financial year. In effect, even though income tax slabs have not been changed under the old and new regime for FY27, fresh calculations will need to be done in cases where the education and HRA benefits have gone up under the old regime.“Salaried taxpayers who choose to get taxed under the new tax regime will not be able to avail the benefit of these enhanced limits. Therefore, salaried taxpayers will need to compare the tax impact based on individual circumstances to decide which tax regime is more beneficial for them,” Shalini Jain of EY India says.A sample comparison by EY for a salaried taxpayer earning gross salary of Rs 25,00,000 is given below wherein the taxpayer may be able to switch to old tax regime based on assumptions highlighted below the tables:

Assumptions:

- Employee is a resident of India and is less than 60 years of age

- Employee lives in city of Pune/ Ahmedabad/ Bengaluru/ Hyderabad

- House rent allowance (HRA) is paid at 50% of Basic Salary by the employer

- Employee will be able to avail exemption of full amount for HRA i.e. 40% under Income-tax Rules, 1962 and 50% under Draft Income-tax Rules, 2026

- Employee will claim deduction of Rs 150,000 under Section 80C (PF, life insurance, home loan principal etc.) and Rs 25,000 under Section 80D (health insurance premium)

- Employee will receive Rs 72,000 per annum towards children education allowance and Rs 216,000 per annum towards hostel allowance from the employer

- Employee will be able to avail exemption of full amount towards children education and hostel allowance

- Exemption for house rent allowance, children education allowance and hostel allowance along with Chapter VI-A deductions will not be eligible if the employee opts for new tax regime

As Richa Sawhney, Partner – Tax, Grant Thornton Bharat points out: Several thresholds have been enhanced to make them more in tune with the current financial realities, factoring in the rising costs of living. It may be useful for salaried taxpayers to reassess their tax positions under the old and the new regime, taking into account these changes, to evaluate which regime works best for them going forward.According to Shalini Jain, from the government’s perspective, the messaging seems to be clear, though in a subtle way, that the old tax regime may continue to remain available in the near future.