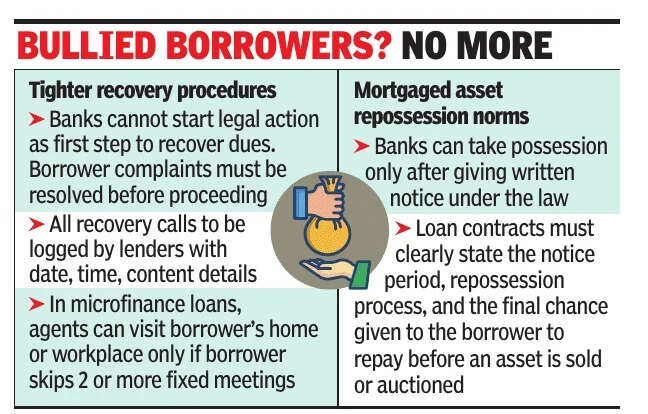

MUMBAI: Reserve Bank of India has tightened recovery and repossession norms to curb harassment and improve borrower protection. The draft amendments require banks to first resolve borrower complaints before starting recovery. Lenders must also disclose the identity of the recovery agent before contact.The changes are part of the draft second amendment to the directions on responsible business conduct and will take effect on July 1, 2026.

As per the draft rules, banks and recovery agents are barred from using harsh practices. They cannot use threatening or abusive language, send inappropriate messages on phones or social media, or harass a borrower’s relatives, friends, referees, or colleagues. The rules also ban public shaming, invasion of privacy, threats or use of violence, and misleading claims about the size of dues or legal action for non-payment.The RBI has also limited when and how borrowers can be contacted. Agents can call or visit only between 08:00 and 19:00 hours. They may deal only with the borrower or guarantor and cannot approach other contacts. Calls and visits must be avoided during events such as bereavements, marriages, or festivals, and banks must respect a borrower’s request to avoid contact at specific times in normal cases.