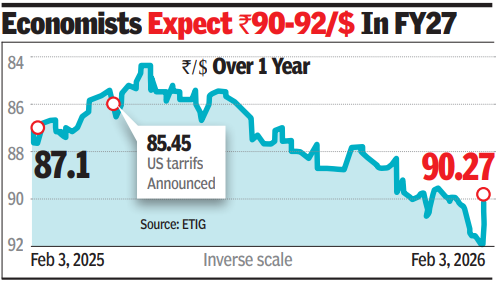

MUMBAI: Reports of an agreement between India and US on a trade deal sparked a sharp rally in the rupee and govt bonds on Tuesday, lifting market sentiment despite the lack of detailed disclosures.The rupee jumped 124 paise to 90.27 against the dollar, its strongest single-day gain in seven years and the best since late 2018. The currency had closed at 91.51 in the previous session and has strengthened 165 paise over two days. The rebound followed a recent record low of 91.99, when corporate dollar hedging and concerns over capital outflows had weighed on the currency.“We see the pair between a range of 89-91.50 over the quarter, supported by the positive trade deal announcement and improvement in seasonal capital inflows. For FY27, we estimate a range of 90-92 for the pair, factoring in a moderate pace of depreciation,” said Sakshi Gupta, economist with HDFC Bank.

What economists expect?

Market participants said the improved mood led to the unwinding of speculative bets against the rupee, including long dollar positions in offshore markets. Expectations of equity-related inflows also supported spot trading. Forward indicators reflected the shift, with short-term forward points and premiums easing, while options pricing showed a lower cost of positioning against the rupee. Currency forecasts were revised stronger, with end-March 2026 projections cut to 89.5 per dollar and end-2026 estimates lowered to 93. Govt bonds also firmed, tracking the positive sentiment. The 10-year benchmark yield fell about 4 basis points to around 6.72%. However, gains were capped as the move provided an opportunity for profit-taking in a market still grappling with weak demand–supply dynamics. Bond prices have remained under pressure since Budget projected record market borrowings in FY27.