A day after presenting her ninth Budget, finance minister Nirmala Sitharaman spoke at length on a range of topics with TOI’s Sidhartha and Surojit Gupta. While she is confident the domestic situation is under control, she feels her biggest challenge ‘will be external’What do you see as the big upside and the downside risk to your assumptions, including growth, given the global and the domestic situation?FM: It’s largely the global situation rather than domestic factors. Domestic situation is well under control in terms of supply-side problems and inflation; consumption has had a good boost. The latest GST numbers show that consumption is sustained at the level that is giving good yields. So, my challenge will be external.Have you also factored in the possibility of a trade deal with the US not happening at all, at least in the near future?That’s not to say it’s happening. That’s not to say it’s not happening. That didn’t come into our minds. When it happens, it happens.You have presented nine Budgets. How difficult is policy-making or Budget-making against the backdrop of how the world has changed?Yes, there are new challenges because of changes in the world. Even at the time of Covid, Budget-making was a challenge. Post revival, we thought of how to step up growth and sustain it — even that was a challenge. Every Budget has its own set of challenges, and it is not just because of global uncertainty.

Given your track record in achieving Budget targets, have you been a little conservative with your estimates on deficit and tax, which included significant giveaways this year due to income tax and GST reduction?Beyond this, I will be stretching my assessment. You have rightly pointed to tax giveaways. GST will not immediately give a big number (collection after rate rejig), although Jan’s data surprised everybody. So, I have to be realistic. I will have to work to expand the tax base on the direct tax side and build a land monetisation pipeline.What kind of measures should we expect on widening the tax base?Two or three things, which are already in practice but will mature. Using information from AI data analytics, you are able to see where money is being spent and you can check if a return is filed. If not, there will be a nudge pointing to the expenditure. The logic behind connecting TDS to large expenditures will be carried forward. If you have assets abroad, please disclose them. That’s not to say we are going to go after everybody. There will also be deep tech analysis of who’s spending huge amounts and then we will approach taxpayers or non-payers and convince them to come on board and widen the base.

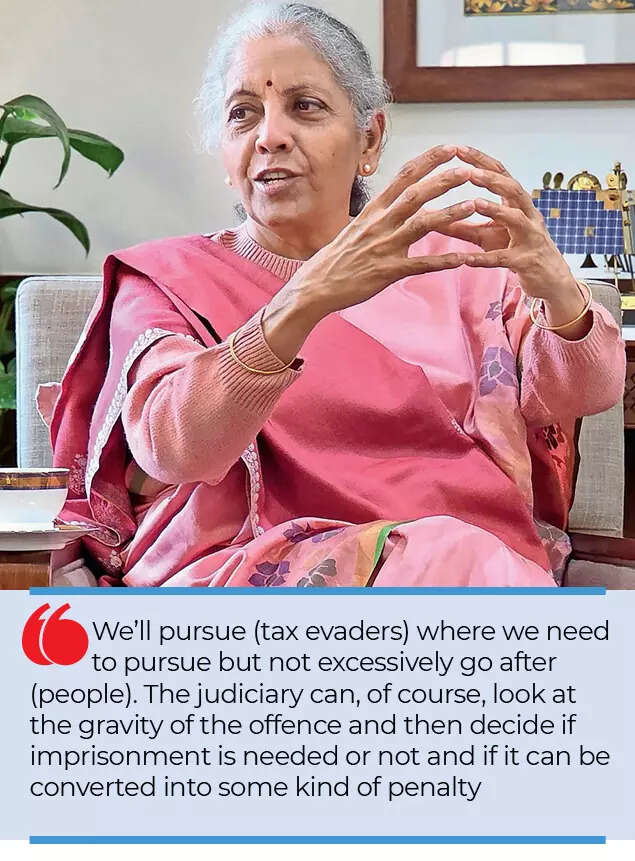

You spoke about helping small taxpayers with compliance and easier filing. What kind of income level are you looking at?Tax mitras will help many small businesses, which want assistance and want to be confident about the returns. That is why through the Institute of Chartered Accountants of India, cost accountants, or ICSI, we want to come up with a set of professionals who offer service at an affordable rate so that small businesses can seek their help and are assured that it is being done by a professional. We received suggestions in this regard and that’s why we decided on this.Decriminalisation in the income tax law was a major announcement. You spoke about maximum two-year jail and no rigorous imprisonment. How will this work? Will the income tax department be less aggressive?We’ll pursue where we need to pursue but not excessively go after (people). The judiciary can, of course, look at the gravity of the offence and then decide if imprisonment is needed or not and if it can be converted into some kind of penalty. We’ll give an option of paying a fee and get away without going to jail. For a few offences, imprisonment provision will still be there, may be cases of fraud or some other serious offence. It will be for the court to decide on imprisonment or letting a person pay some money and go away.There is a lot of focus on simplifying customs processes and reposing more trust. You had reduced the number of slabs last year. Going forward, will you rewrite the law and reduce slabs further?That’s been happening for the last two years. They are already working on it (rewriting). Some are disclosed in this Budget; they (the department) will carry forward that work. It’s time-consuming work.You have persisted with robust capex. Is there firepower in case the global situation turns adverse? Are you seeing a pick-up in private sector investments?There is certainly a pick-up in private sector investments. I hope, with the kind of India’s domestic market and the robustness seen in exports, there will be further growth in private investments.You have pitched it as a Yuva Shakti Budget. What prompted you to focus on youth?We received so many inputs from them. The PM participated in the My Bharat dialogue. For education, skilling and entrepreneurship, we have set up a standing committee. You will be able to acquire skills before completing your education and it will help you become an entrepreneur. Two-three ministries will work together. Youth is not just about men. In rural areas, there are several Lakhpati Didis. In Nagaland, due to the rural employment programme, many have become businesswomen. There is a way to move from self-help groups to entrepreneurship, that’s why SHE-Marts came about.I have announced waterways, which pass through the mineral corridor and some, where Nishads live. This community is skilled in repairing and making boats. At the institutes of excellence, they can acquire further skills on maintenance and other aspects. Seaplanes in coastal areas will also create jobs for the youth.There is a partnership on education and skilling. How can the private sector help in this?We are working with industry on skilling, because in this age of technology, govt can’t work alone. Industry’s requirements are continuously evolving.What will be the focus of the orange economy?It will be on AVCG, animation, cartoon videography and gaming. In Japan, Studio Ghibli has been able to integrate man-made pictures with technology and share Ramayana. We need to do all this in India. The idea is not just about content creators but there are several other elements.Is this to prepare the workforce for the future and also fill the skill gap, especially in areas where there may be challenges in future such as geriatrics?India’s population is aging and there will be a need for services for which manpower should be made ready. We are constantly, and rightly so, looking to educate children to become doctors and nurses and we still need to support that. But we also need paramedics, physiotherapists, psychologists, radiologists. Even that cadre needs support. That is why we made a mention of that one lakh additional Allied Health Professionals.On STT, you have stated that the intent is to protect retail investors from excessive speculation. Could this have been handleddifferently, since some foreign investors — who are already exiting the market — will have to face additional costs?They are not coming into options. Can we compensate 90% of the retail investors who are losing money in the F&O segment? It is not for the cash segment. We have only touched the F&O trade, which is highly speculative. I have received calls from many parents saying their children are severely losing money, and also seeking govt intervention. The STT hike in F&O will act as a deterrence so that people do not go headlong with that.You have introduced capital gains tax on sovereign gold bonds for those who purchase from the secondary market. What is the intent behind the move?Original intent was that you will hold the bonds till maturity. It’s not buying and selling, we were asking you to invest and leave it there.Gold and silver prices have gone up significantly and anecdotally, it appears that some investors are getting overexuberant about getting into these two commodities. Is there a need to sensitise investors?I don’t think we have seen individual citizens buying and selling. Gold price is fluctuating in the global market because of different reasons. Even central banks in various countries are investing in gold. Investment by consumers in gold is a personal choice.Given that we are signing several FTAs, have you also factored them to prepare industry to take advantage of these agreements?Very clearly, we are supporting labourintensive sectors such as leather, textile, sports goods, marine products and shrimps. It will boost exports.You have not made specific reference to the states despite elections in five states. Why?(Laughs) We have steps for electionbound states. Mineral corridor, rare earth corridor for Kerala and Tamil Nadu. Actually, others can complain that Tamil Nadu has got defence and a rare earth corridor. Kerala economy depends on coconut, somewhat Tamil Nadu. Cashew for Kerala.Some people said that you wore a Kanjivaram sari for Tamil Nadu and not one from Bengal. Last year you wore a Madhubani sari. You didn’t name the states.I can’t wear three saris on the same day. I mentioned Kerala, Tamil Nadu and in West Bengal Dankuni, Durgapur, Siliguri. I mentioned high-speed train in Chennai.You have allocated Rs 95,000 crore for G Ram G. The opposition has raised its concern over the scheme, including on cost-sharing between the Centre and the states. How do you respond to it?It shows that we are committed to the cause of taking care of people who need jobs on demand. When we hiked it to 125 days from 100 days, people said, how will we do it. We allocated the money to meet that demand. We have also given money for that old scheme, MNREGA, because payment has to be made. Utilisation certificates will come later, so we are not denying that money, it’s a substantial amount. I have allocated Rs 95,000 crore for VBG RAM G and Rs 30,000 crore for MNREGA. So, let us see what campaign they want to run now. In their tenure, having brought this law, they didn’t give one-tenth of this. Even though 100 days was promised, the demand was less. The demand was spurious; CAG also commented on it. Someone over 80 years old was going to dig ponds, they are all getting funds under MNREGA. That is why, in this scheme, we have brought a setup where the state govt also has a skin in the game. You think in states like Uttar Pradesh, Bihar and Jharkhand, there will be large demand for work under MNREGA, but demand is not so much. States, which say we are developed, we are contributing to GDP but don’t get that kind of money back (from the Centre), see demand under MNREGA go up so much. So, these things will get controlled.You spoke of REITs by central PSUs. Will it be a significant part of the Rs 80,000 crore that you have budgeted for under assetmonetisation. You also mentioned more public floats by PSUs. Can you help us understand the disinvestment and asset monetisation plan? Also, do instruments like REITs address concerns that officers have on land sale or PSU privatisation?As an instrument REIT has worked well. Pension funds which come into India also have confidence that the instrument is very effective and they will be happy to invest. On your point on officers being more comfortable, I understand that, but it is not for that reason that a substantial number of land monetisation work has not happened. Some departments which have enough land assets are unable to carve out land parcels due to litigation or are not free of encumbrances. You need a pipeline with parcels or assets that are encumbrance-free; only then can you find an interested buyer. In the past, progress has been affected due to these sorts of things.One of the success stories last year was the turnaround of power discoms due to reforms-linked incentives to states and also regulations issued by the Centre. Does this focus need to continue?Yes, this has to continue; it has to be sustained.Last time, when the Finance Commission report had come, the Centre was attacked and now balance seems to have been restored. But states, irrespective of political colour, have demanded an increase in the share, while the Centre has argued that it has to meet defence and other spending needs, including those related to health, education and even jobs.First, I won’t comment on the Finance Commission report. Cabinet has seen it, approved it and that is why I tabled it in the House. It won’t be right on my part to comment on a constitutional body’s recommendation. The Centre will have to look at its revenue sources and that’s why disinvestment and other things, non-tax revenue, will actually be improved upon. Without that we are going to have to face a lot of challenges because our demands are mounting whether it is defence, whether it is pay commission which is yet to submit its report. Whether it is also skilling or health activities, or the semiconductor mission, agriculture and farming or R&D, all need to get support. Central govt is funding and that cannot come down. So, we will have to look at sources of revenue.You have announced several steps but you did not undertake major reforms in the Budget and instead sought to steady the ship, taking a middle path…There are reforms outside the Budget, too. It is not middle path. Since 2014, we have undertaken several reforms outside the Budget, labour codes, IBC, GST. Even now, IBC has returned from IBC, we are planning to amend the Companies Act. There is a lot of reform outside the Budget. We focus a lot on the Budget, and rightly so, but you need to factor in reforms outside the Budget, too. Reforms are for the development of the country and for faster growth. Whatever is needed will be done.Govt has rationalised subsidies in the oil sector, but not so much in food and in fertiliser. It’s a politically difficult thing to do. Given that poverty levels have come down, when can the Centre and statesdecide on beneficiaries, because some of the people may not need that subsidy now?That’s a call which different ministries will have to sit together and take. I am not commenting either this way or that way, but it involves so many different factors. We also need the Census data because we still have 2011 data and it’s been 15 years since then. The new Census itself will give us some direction on how many people are below poverty (line), what is the kind of spread there, and where they are present.Net FDI has been a bit of a concern. The focus is on increasing inward FDI. How much of a dampener is the current global environment and how will you pitch India as a more attractive destination?Globally, fund movement is determined by the strategic considerations elsewhere, not just for India. Second, the reason why we are constantly talking about part B of the Budget is because of the various proposals that we have come up with for making India a better destination for investment, for job creation. Steps are taken with an expectation that we will be able to get over some of the systemic glitches which existed earlier. We are moving in the direction of making India a better and attractive investment destination, but fund flows depend on many other factors, which are beyond India. Norway and Canada are speaking to me, speaking to the commerce minister (Piyush Goyal) on investing more in India and how we can facilitate that. We are working with the counterparts concerned to enable that.How much of a policy concern is outward FPI flow and the impact that it is having on the rupee and the overall sentiment?I am here to make sure that the macroeconomic fundamentals are strengthened. Policy will enable it. Ease of doing business will make India an attractive destination. Funds come, funds go and I am not saying it is not important. We need funds. We welcome them and we will work to get them.Will the high-level committee look only at banking reforms or on the financial sector as a whole?Banking. Basically, it will help us prepare the roadmap for 2047 How will the infrastructure risk fund work?Many of the risk which investors face will have to be supported by some measure or the other. That’s why we have come up with this. The finer details are being worked out.You have presented nine Budgets; which one do you see as a milestone?Each Budget is a challenge. Each Budget is a sort of rigorous exercise. And I have a sense of satisfaction about each of them for the context in which they were made.All constructive?I am not sure if any of my Budgets were populist, all of them have sought to be constructive.