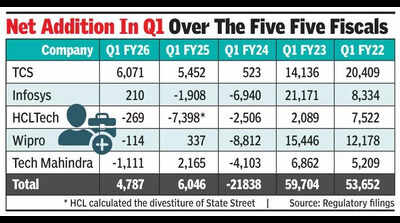

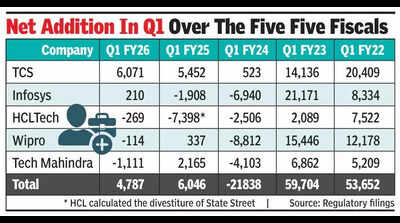

Top IT cos add 4,787 in Q1; hiring moves from freshers to specialists | Bengaluru News

Bengaluru: There is literally not enough room for freshers in India’s top IT firms. These companies recorded two consecutive muted hiring quarters in June for the 2024-25 and 2025-26 financial years. Net additions fell below 10,000 in the June quarter, reflecting ongoing caution amid persistent demand uncertainty.Firms are increasingly prioritising domain specialists, and with AI handling many L1 and L2 tasks, they are now seeking professionals with cross-functional, full-stack skills that are interoperable across teams.Collectively, TCS, Infosys, Wipro, HCLTech, and Tech Mahindra added just 4,787 employees. TCS led with 6,071 net hires, while Infosys followed with a modest 210. In contrast, HCLTech, Wipro, and Tech Mahindra reported net reductions of 269, 114, and 1,111 employees respectively, highlighting the challenges freshers face as firms increasingly focus on hiring domain-specialist lateral entrants in the current environment.This marks a sharp decline from the June quarter of the 2021 fiscal year, when the same group recorded net additions of 53,652 — followed by 59,704 in 2022-23, and 21,838 in the June quarter of 2023-24, with Wipro, Infosys, and Tech Mahindra accounting for the bulk of the contraction.“Traditional metrics like net hiring and utilisation no longer reflect growth in the IT services industry,” said Ramkumar Ramamoorthy, partner at technology advisory firm Catalincs. “These numbers also carry social implications. In the context of AI and digital, there is an urgent need for India to reimagine its higher education system. We need to emphasise applied problem-solving, interdisciplinary thinking, creativity, and adaptability to remain relevant.“Industry experts believe that hiring is largely concentrated in niche areas such as AI, cloud, and cybersecurity, with ramp-ups occurring primarily through large deal wins.“Most new jobs are tied to specific projects or organisational changes, rather than large-scale hiring drives. This cautious approach reflects companies’ focus on filling critical roles that drive growth and adaptability. While the job market is gradually improving, businesses are being strategic about who and when they hire. It is less about volume and more about making thoughtful hires to address key needs. For job seekers, opportunities exist, but success depends on having the right skills and flexibility to navigate the evolving market,” said Neeti Sharma, CEO at Teamlease Digital.While demand for AI, data, and automation talent is surging, the available talent pool in India faces a significant skill gap. For large IT companies, upskilling and internal talent transformation have become more crucial than ever. “From these factors, it is clear that India’s tech talent story is being rewritten,” said Sunil C, India Country Head at Adecco. “It is not just about volume anymore. The race is about building future-ready teams, rebalancing talent supply chains, and staying competitive in a landscape defined by constant change,” he added.Even as upskilling and reskilling remain constant priorities, Indian IT is no longer making headlines for aggressive hiring, as headcount growth has decoupled from revenue gains. Instead, companies are increasingly turning to campus recruiting to onboard students trained in newer skill areas.