ICICI’s UPI fee to pinch fintechs

MUMBAI: Payment aggregators are feeling the pinch as ICICI Bank has now started charging them for processing purchases made using UPI,Fintechs that route transactions through the bank must now factor in new charges, intensifying the debate on the long-term viability of free digital payments. Payment aggregators with escrow accounts at ICICI will be charged two paise per Rs 100 processed, capped at Rs 6 per transaction. Those without such accounts will pay double – with a Rs 10 cap. Merchants who settle directly into ICICI Bank accounts will continue to receive UPI services at no cost.

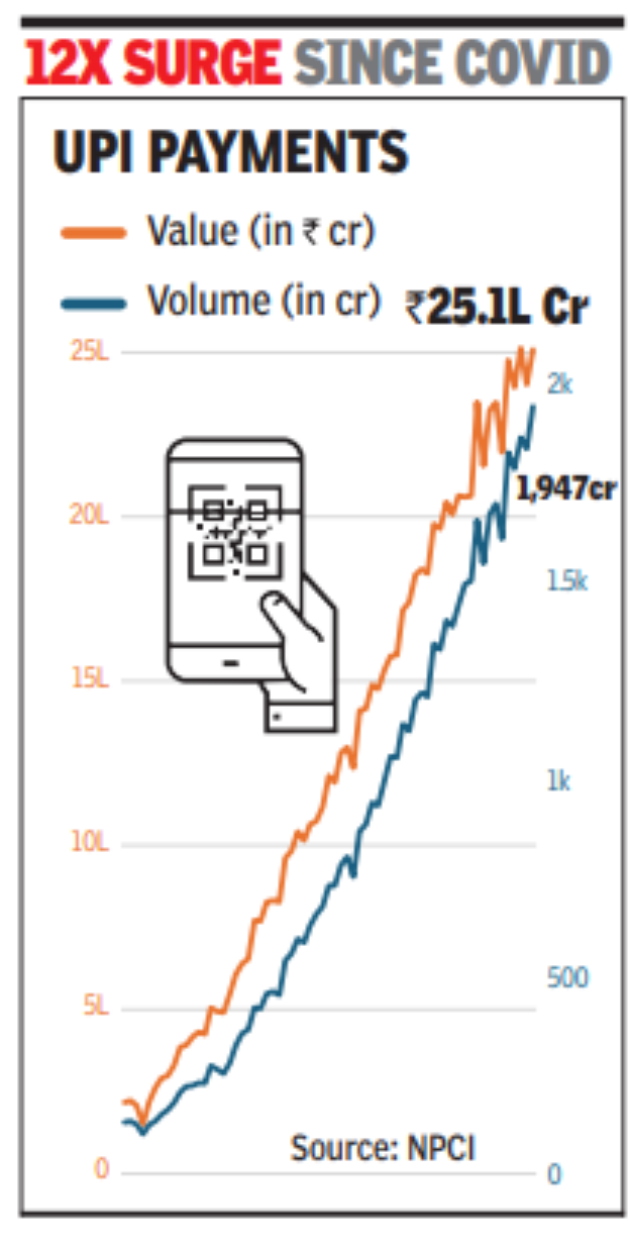

Firms such as Razorpay, PayU, Pine Labs, Innoviti and Worldline operate at the interface between large retailers and customers, enabling acceptance of card, wallet and UPI payments, Collecting merchant discount rates on card payments and a platform fee on UPI,while relying on partner banks to access the payments infrastructure. Under the UPI framework, banks provide identification, process transactions and absorb the cost of scale. With UPI volumes climbing, some banks have grown wary of bearing backend expenses of processing transactions without direct returns, particularly as both merchants and consumers pay nothing for the service.According to payment aggregators, at least two other private banks – Axis Bank and Yes Bank impose similar charges, indicating a broader shift in approach.Govt has maintained that UPI is a public good and must remain free for users and small merchants. However, over 1,900 crore transactions worth Rs 25 lakh crore in a single month have added financial strain. Aggregators, caught between rising bank charges and regulatory expectations, have avoided passing on costs to merchants, choosing instead to subsidise UPI from other income streams. The principle of free payments is under scrutiny. RBI governor Sanjay Malhotra said UPI needs to be sustainable and that “someone will have to bear the cost” of running the system.